Steve Mnuchin uses partial data to say GOP tax bill favors middle-income households

"On the personal tax side, middle-income people are getting cuts and rich people are getting very little cuts or, in certain cases, increases" under the…

"On the personal tax side, middle-income people are getting cuts and rich people are getting very little cuts or, in certain cases, increases" under the…

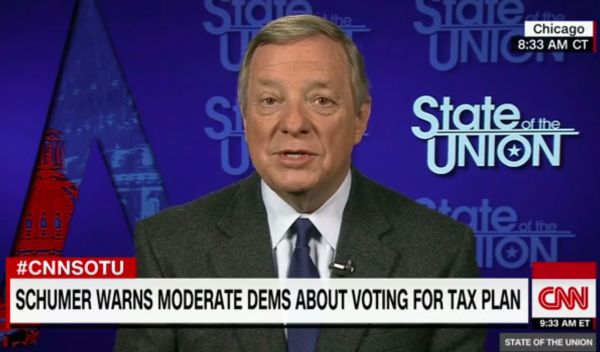

Congressional Republicans "want to take health care from millions of Americans in order to pay for" a tax bill.

"There are ‘sore loser’ laws that would bar Luther Strange from pursuing a seat" because he already lost the Alabama Republican Senate runoff to Roy…

The Republican tax bill is "not being scored by the Congressional Budget Office, as it is traditionally."

Says the Republican tax plan "helps families" like one in which a woman lost her job and then lost her life savings fighting her husband’s…

The Republican tax bill "lets every American keep more of what they earned."

"Teachers spend $1.6 BILLION per year on school supplies. The Republican tax bill ELIMINATES their ability to deduct those expenses."

"Under the Tax Cuts and Jobs Act, the average American family of four will receive a $1,182 tax cut."

Under the House Republican tax proposal, "the average family of four earning median income ($59,000/year) will receive an additional $1,182 in their pocket every year."

"With this plan, the typical family of four will save $1,182 a year on their taxes."

Says the diversity visa lottery program is "a Chuck Schumer beauty."

Says the GOP plan he supports is "the biggest tax cut in U.S. history."